Lessons in Partnerships Strategy From Cloudflare’s Q1 2025 Earnings Call

Cloudflare’s Q1 ’25 results prove that a platform-first, partner-led strategy can create outsized enterprise momentum, even in a choppy macro environment.

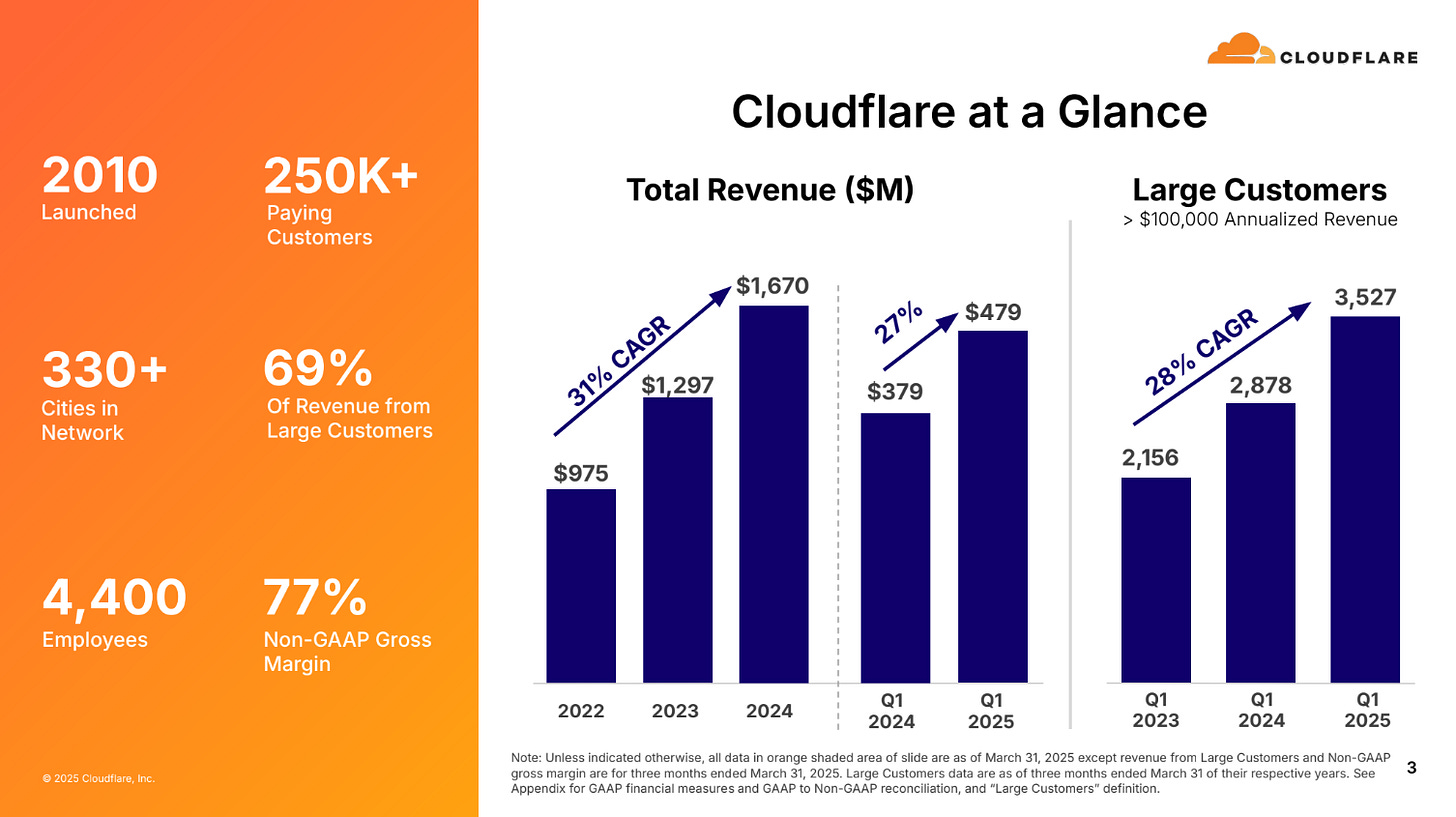

Cloudflare posted stellar Q1 2025 results, with 27% year-over-year revenue growth, 23% growth in large customers (>$100,000 annualized revenue), and a dollar-based net retention rate of 111%. That was music to the ears of those on Wall Street, with the stock popping +2.3% intraday and rallying since then to almost $170 - a 40% gain in less than a month.

The best bit? Partners had an outsized impact on these results. Here’s some stand-out partnerships strategy lessons from Cloudflare’s Q1 2025 earnings call.

1. Make partners your force-multiplier

For Cloudflare, channel-sourced ARR is compounding faster than direct, with their channel business growing 60% year-over-year, now representing 23% of revenue - up from 15% a year ago.

Partners drove ~$110 million of Cloudflare’s $479 million Q1 2025 revenue.

Partners aren’t just helping Cloudflare scale product innovation or existing customer relationships - they’re also helping Cloudflare land new deals. Cloudflare CEO, Matthew Prince, even mentioned a sizable partner-led deal in his prepared remarks:

“A large US government entity signed a two-year $6.2 million contract for Zero Trust. This customer evaluated several vendors to comply with new Federal Zero Trust requirements, and Cloudflare ultimately stood out as the vendor of choice due to our world-class security products and the breadth of our network. This was a partner-led deal and a great example of the progress we continue to make with our partner-first motion.”

Matthew also mentioned another interesting improvement in Cloudflare’s business:

“…another double-digit year-over-year improvement in sales productivity. We saw quarter-over-quarter improvement in our sales cycles even as we closed larger deals with more sophisticated buyers. And our new pipeline attainment was ahead of our forecast.”

Double-digit likely means a +12-15% improvement in sales productivity over the previous year. In practice this means more ARR per rep without adding incremental headcount. Creating a lot more operating leverage for Cloudflare.

Are these sales productivity improvements influenced by partners? Absolutely.

36% of the Fortune 500 are paying customers, and there’s no way Cloudflare could serve their needs - alongside the needs of 250,000+ paying customers in 190 countries - on their own. Cloudflare simply must be partner-first to serve each of them well.

2. Measure what partners move

It’s no accident Cloudflare keeps a close eye on large customer contribution (the % of total ARR coming from accounts >$100k ARR), sales productivity, and channel mix.

Each of these is closely related - one very much influences the other.

Of course Cloudflare also keep a close eye on dollar-based net retention which is still strong at 111% - and they say large customers are a long-term tailwind to their DBNR.

So, what can platform partnerships teams learn from this? Three lessons:

Instrument at the opportunity level (wherever you can)

Simple CRM tags for partner-sourced, partner-influenced, or direct can go a long way. Roll these up into large customer contribution and dollar-based net retention dashboards to answer the question “do partners help us win new customers and keep them longer?” Money talks, even for product-led partnerships teams.Slice partner sourced/influenced by customer size and cohort

Dollar-based net retention will almost always look different for enterprise, mid-market, and SMB customers. The same will be true of partner influenced and partner sourced deals. A rising partner tide should lift the enterprise cohort fastest (as Cloudflare’s revenue growth inside this segment shows, and as I’ve witnessed myself over the years).Surface “partner-first” stories

Was Matthew Prince directly involved in the $6.2 million contract for Zero Trust mentioned in his prepared remarks? Probably not - he’s running a 4,400 employee, publicly-listed company. The deal was likely surfaced to him from the partnerships and/or sales org to highlight the value of partners to Cloudflare. Storytelling must be a core skill for every platform partnerships team. The more mindshare partners have, the more they’ll feel like “part of the extended team.”

3. Flywheels spin faster in an AI-first world

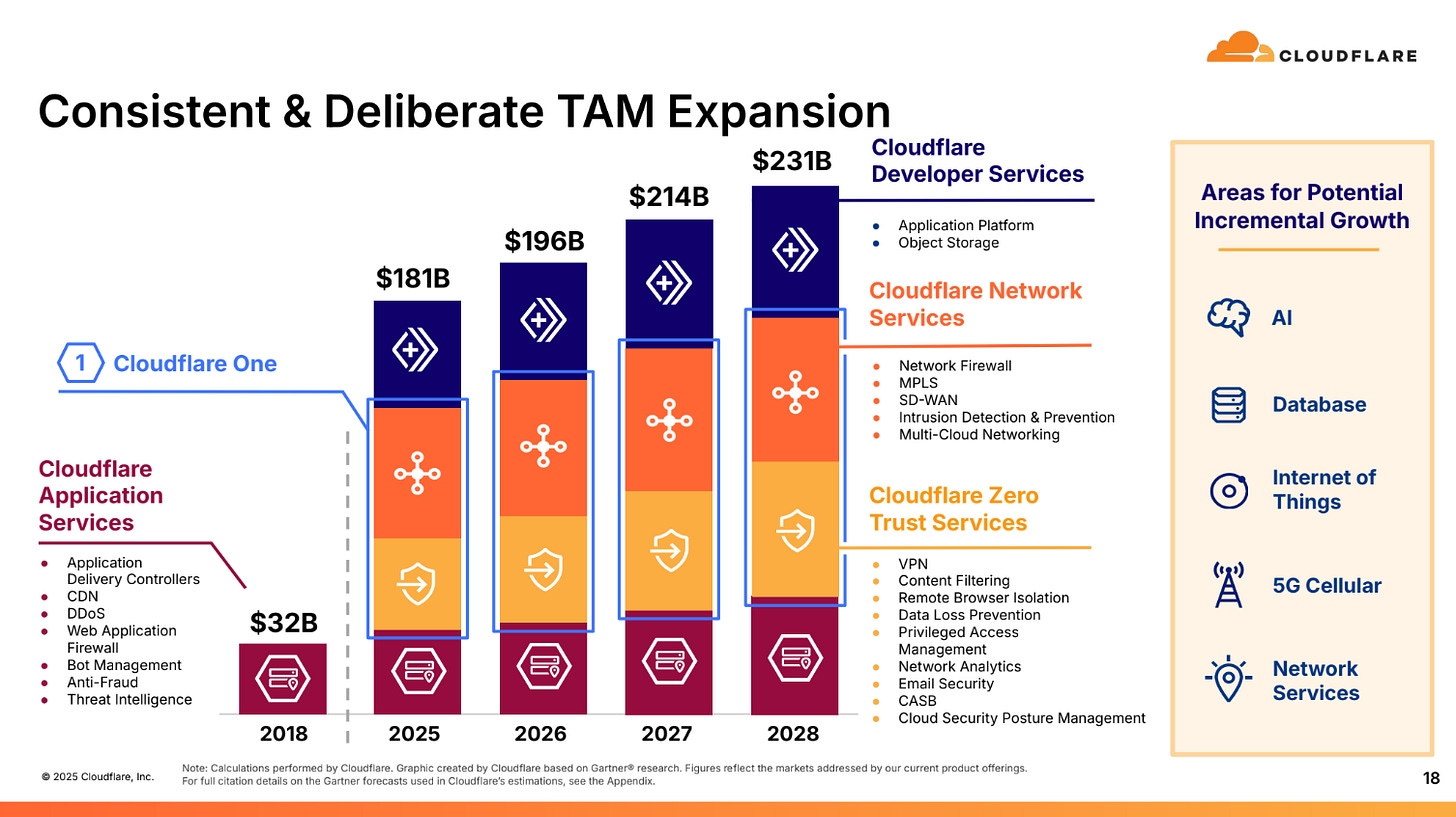

AI is an important inflection point for Cloudflare, and for its partners. It creates new opportunities to follow through on a “Consistent & Deliberate TAM Expansion” plan.

Cloudflare talked about three AI-first updates in their Q1 earnings call related to Anthropic’s new MCP standard, hyperscaler displacement, and VAR-influenced credibility.

Cloudflare’s platform flywheel has already been spinning up for a while. AI is already making that same flywheel spin faster. Matthew Prince again:

“The number of Cloudflare Workers AI inference requests powered by our network are up nearly 4000% year over year. The number of requests running through our AI gateway are up more than 1200% year over year. We continue to invest in the future, building the first, fastest, and most powerful model context protocol or MCP server.”

4000% year over year growth is impressive, even by “AI” standards. Much of that growth is being generated through partnerships with market-makers like Asana, Atlassian, Block, Intercom, Linear, PayPal, Sentry, Stripe, and Webflow.

These types of partnerships are quick-fire “bets” - likely without any negotiated agreements or commitments. The mutual goal is to get out ahead of the market and become known as AI-innovators. But for Cloudflare, AI inference and gateway requests already seem to be generating incremental revenue value.

Moving fast with partners also helps Cloudflare uniquely position itself vs hyperscalers like GCP, AWS, and Azure. Each fast-moving MCP integration (and partnership) helps Cloudflare tell their unique platform story.

Matthew Prince, yet again:

“And I think that that comes back to the fact that the team has just built such a robust platform at this point that, that that people are saying we’re gonna move off the traditional hyperscalers and move to Cloudflare because the ROI is just so much better, the performance is so much better, and and the development philosophy is so much better.”

These stories aren’t just powerful because they’re Cloudflare’s to tell - partners can tell them, too. Every little win - thenZero-Trust deal, MCP server launches, and AI capability growth - make Cloudflare an easier sell for partners, too.

Partners also bring their own credibility to the table. AI-first is an opportunity for most businesses, but also a perceived risk. A government-accredited VAR brought Cloudflare in for a $6.2 million deal - that VAR helped build trust between Cloudflare and the customer, faster.

Cloudflare’s Q1 2025 shows us that a strong combination of platform, partnerships, and a new technology wave can - combined - create a vast amount of market value, quickly.

If you enjoyed reading this post - or would like to ask me a question - comment below or reach out to me on LinkedIn.